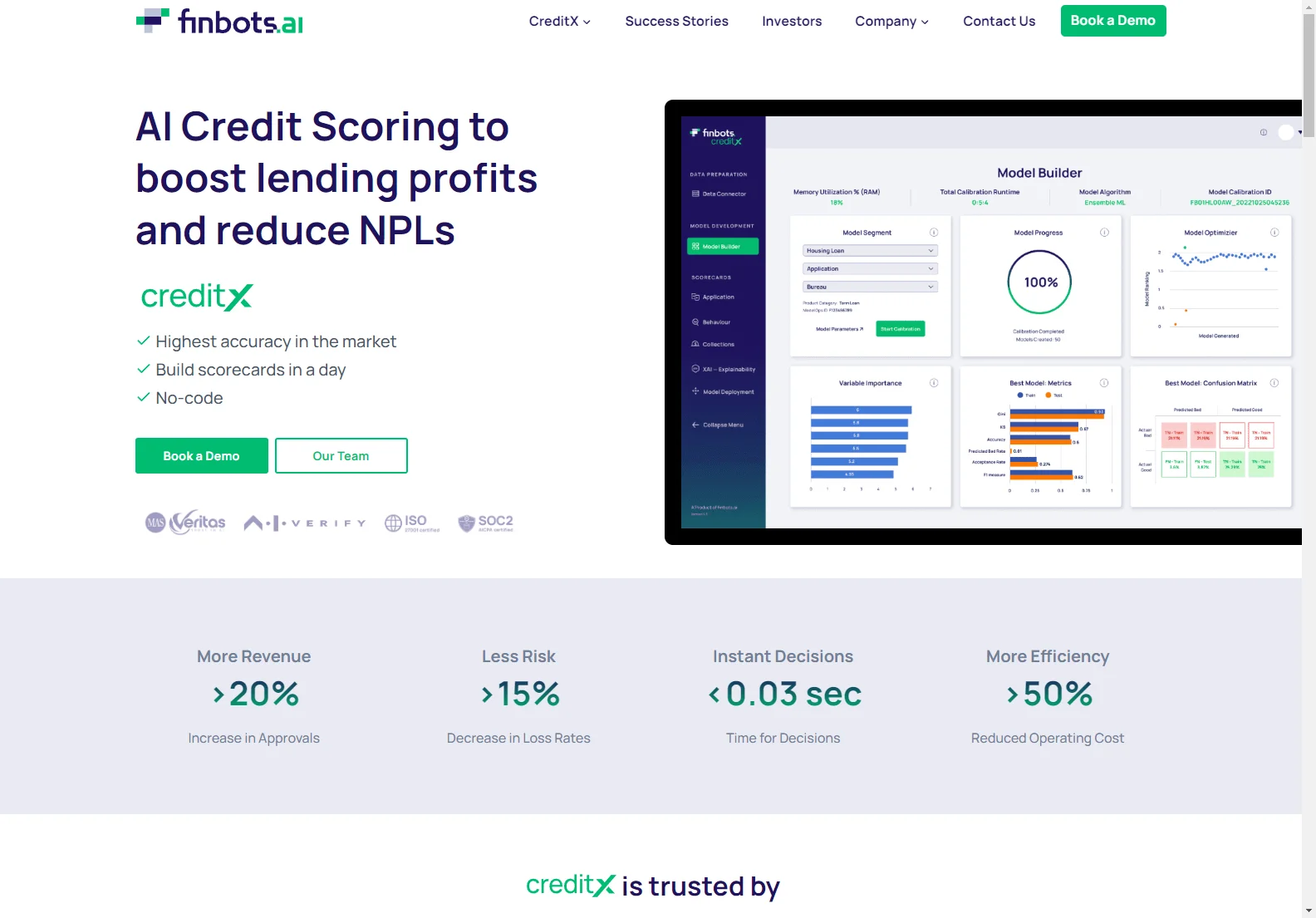

finbots.ai: Revolutionizing Credit Scoring with AI

finbots.ai's creditX is a groundbreaking AI-powered credit scoring platform designed to significantly boost lending profits while simultaneously reducing non-performing loans (NPLs). This innovative solution offers unparalleled accuracy, enabling lenders to build custom scorecards in a matter of hours, not months. Its no-code interface makes it accessible to a wide range of financial institutions, from established banks to agile startups.

Key Features and Benefits of creditX

- Unmatched Accuracy: creditX leverages powerful, proprietary AI algorithms validated by regulators, ensuring the highest accuracy in credit scoring.

- Rapid Scorecard Development: Build and deploy custom scorecards in a single day, drastically reducing time-to-market compared to traditional methods (which can take 9-12 months).

- Enhanced Efficiency: Automate the entire credit scoring process, from data ingestion to model deployment, resulting in a >50% reduction in operating costs.

- Increased Approvals and Reduced Risk: Experience a >20% increase in loan approvals and a >15% decrease in loss rates.

- Instant Decisioning: Make credit decisions in under 0.03 seconds, improving customer experience and operational efficiency.

- Compliance and Regulation: creditX adheres to all relevant regulatory and compliance requirements, including data privacy, security, and fairness.

- Explainable AI: creditX utilizes transparent and explainable AI, ensuring fairness and meeting regulatory requirements.

- Scalability: creditX is designed to handle large volumes of data and support the needs of lenders of all sizes.

How creditX Works

The creditX platform streamlines the entire credit scoring process:

- Data Ingestion: Seamlessly integrate internal, external, and alternative data sources.

- Data Treatment and Feature Engineering: creditX automatically cleans, transforms, and engineers features from your data.

- Model Building and Validation: creditX's AI algorithms build, validate, and ensure the explainability of your custom credit scorecards.

- Deployment: Deploy your custom scorecards with a single click, enabling instant decisioning.

Case Studies

- Sathapana Bank: creditX has helped Sathapana Bank enhance its credit risk management and improve operational efficiency and agility.

Why Choose finbots.ai?

finbots.ai is a Singapore-based fintech company with a team of experienced financial professionals and AI/ML experts. Our commitment to innovation and regulatory compliance makes creditX a trusted solution for lenders worldwide.

Conclusion

finbots.ai's creditX is transforming the lending landscape by providing a faster, more accurate, and more efficient way to assess credit risk. Its user-friendly interface, powerful AI capabilities, and commitment to regulatory compliance make it an ideal solution for lenders seeking to improve profitability and reduce risk. Contact us today to learn more about how creditX can benefit your lending business.