Trending Stocks Today: Price, News, Sentiment, and AI Analysis

This article explores the use of AI in analyzing trending stocks, focusing on price movements, news sentiment, and overall market trends. We will examine how AI-powered tools can help investors make more informed decisions.

Understanding the Landscape

The stock market is a complex and dynamic environment. Traditional methods of analysis often struggle to keep pace with the sheer volume of data available. This is where AI steps in, offering powerful tools to process and interpret vast quantities of information, identifying patterns and trends that might be missed by human analysts.

AI-Driven Stock Analysis

AI algorithms can analyze various data points, including:

- Price data: Historical and real-time price movements, volume, and volatility.

- News sentiment: Analyzing news articles, social media posts, and financial reports to gauge market sentiment towards specific stocks.

- Financial reports: Processing earnings reports, balance sheets, and other financial statements to identify key performance indicators.

- Social media trends: Monitoring social media platforms for mentions of specific companies and assessing the overall sentiment.

By combining these data sources, AI can generate insights into potential market movements and help investors identify promising investment opportunities.

Real-World Applications

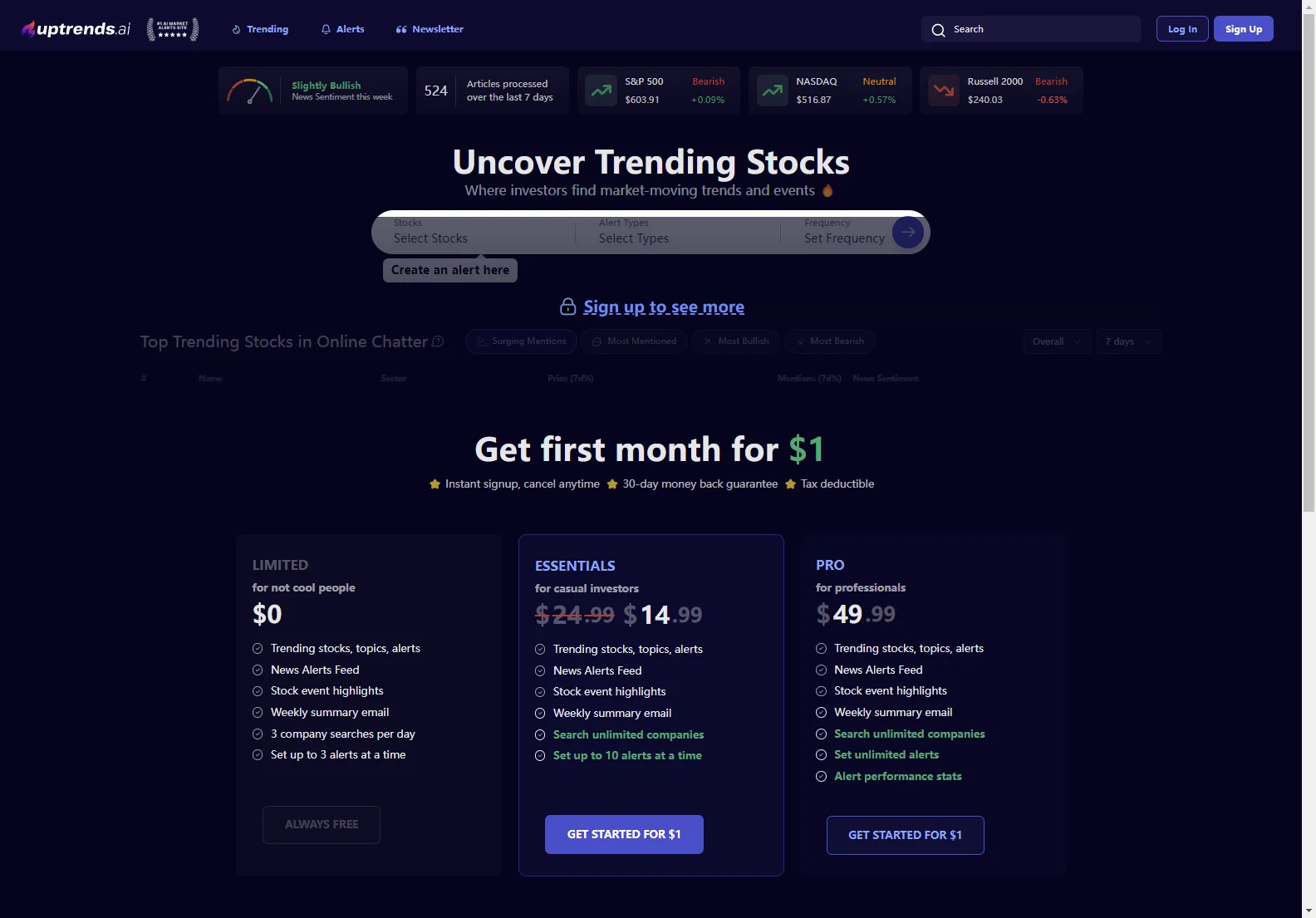

Several AI-powered tools are already available to assist investors. These tools often provide:

- Trending stock alerts: Real-time notifications about stocks experiencing significant price changes or news events.

- Sentiment analysis: Assessment of overall market sentiment towards specific stocks or sectors.

- Predictive modeling: Forecasting potential price movements based on historical data and current trends.

Benefits of AI in Stock Analysis

The advantages of using AI for stock analysis include:

- Increased efficiency: AI can process vast amounts of data much faster than humans.

- Improved accuracy: AI algorithms can identify subtle patterns and trends that humans might miss.

- Reduced bias: AI can eliminate emotional biases that can affect human decision-making.

- Enhanced risk management: AI can help investors identify potential risks and opportunities.

Challenges and Limitations

While AI offers significant advantages, it's crucial to acknowledge its limitations:

- Data dependency: AI models are only as good as the data they are trained on. Inaccurate or incomplete data can lead to flawed predictions.

- Overfitting: AI models can sometimes overfit to historical data, leading to poor performance on new data.

- Unpredictability of the market: Even the most sophisticated AI models cannot perfectly predict the future of the stock market.

Conclusion

AI is transforming the way investors analyze the stock market. While it's not a magic bullet, AI-powered tools can provide valuable insights and assist investors in making more informed decisions. However, it's essential to use these tools responsibly and critically evaluate the results, always remembering that the stock market remains inherently unpredictable.