Intuit Accountants: Professional Tax Preparation Software

Intuit offers a suite of professional tax preparation software designed to streamline workflows and enhance efficiency for accountants and tax professionals of all sizes. Whether you prefer cloud-based solutions or desktop applications, Intuit provides options to fit your firm's unique needs. This article explores the key features and benefits of Intuit's ProConnect Tax, Lacerte Tax, and ProSeries Tax software.

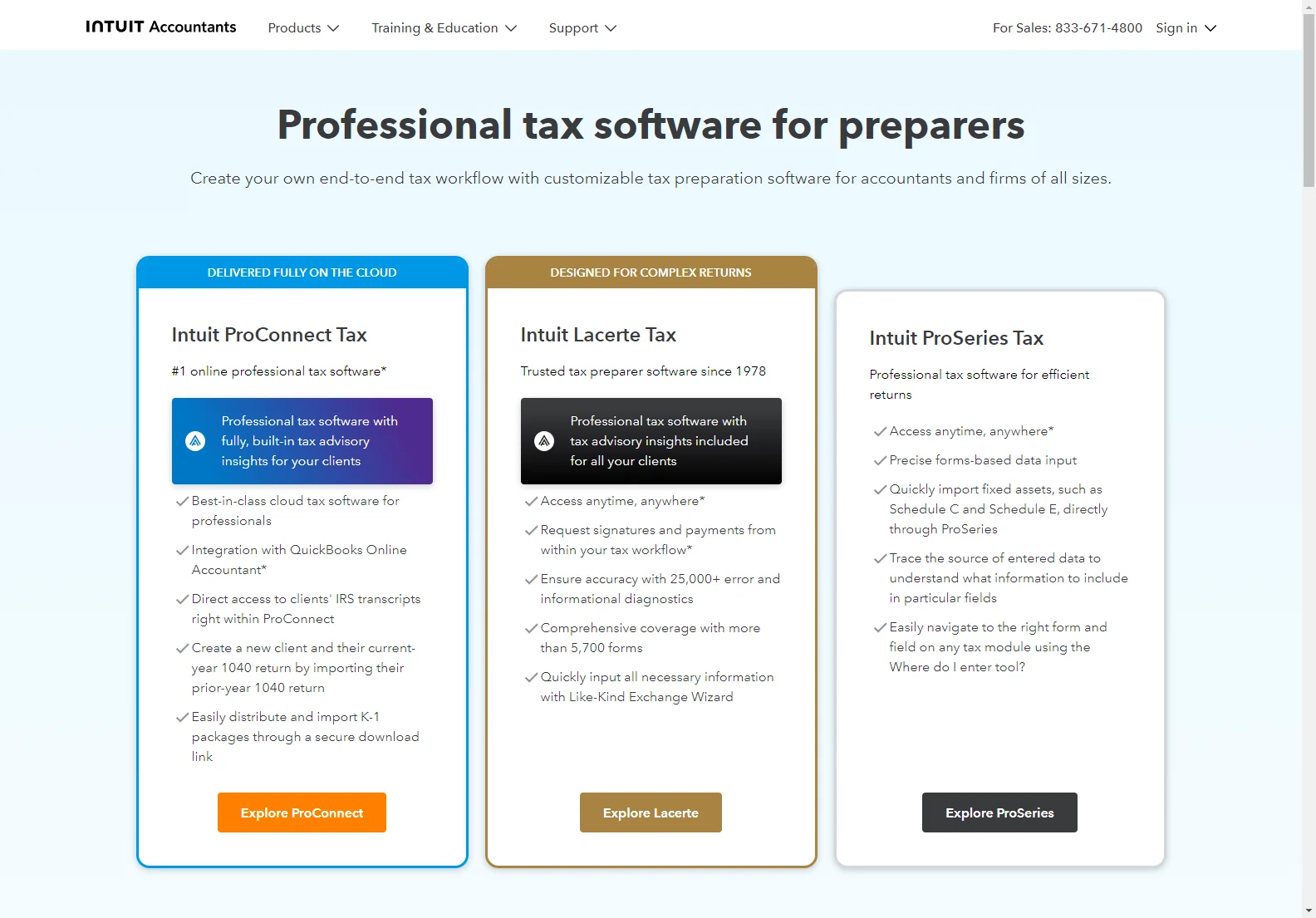

Intuit ProConnect Tax

ProConnect Tax is a fully cloud-based solution, offering unparalleled accessibility and collaboration features. Key features include:

- Seamless Integration: Integrates with QuickBooks Online Accountant for a streamlined workflow.

- Client Access: Direct access to clients' IRS transcripts within the platform.

- Data Import: Easily import prior-year 1040 returns to create new client profiles.

- K-1 Management: Securely distribute and import K-1 packages.

- Tax Advisory Insights: Built-in insights to enhance client advisory services.

Intuit Lacerte Tax

Lacerte Tax is a powerful desktop or hosted solution, trusted by tax professionals since 1978. Its strengths lie in:

- Comprehensive Coverage: Supports over 5,700 forms and includes extensive error diagnostics.

- Tax Advisory Insights: Provides tax advisory insights for all clients.

- Accessibility: Access anytime, anywhere.

- Workflow Efficiency: Streamlines workflows with features like e-signatures and payment requests.

- Specialized Tools: Includes tools like the Like-Kind Exchange Wizard for efficient data input.

Intuit ProSeries Tax

ProSeries Tax is a desktop or hosted solution ideal for small to mid-sized firms. It excels in:

- Efficiency: Designed for efficient return preparation.

- Accessibility: Access anytime, anywhere.

- Data Import: Quickly import fixed assets and other data.

- Intuitive Navigation: The "Where do I enter" tool simplifies form navigation.

- Data Tracing: Trace the source of entered data for accuracy.

Choosing the Right Software

The best software for your firm depends on your specific needs and firm size. ProSeries is suitable for smaller firms, Lacerte for larger firms with complex returns, and ProConnect for those seeking a fully cloud-based solution. Intuit offers resources to help you choose the right fit.

Additional Features Across All Platforms

Intuit's tax preparation software offers several additional features to enhance efficiency and client service, including:

- App Integrations: Customize your software with essential tools.

- Quick Employer Forms: Generate 1099 and W-2 forms directly from the software.

- eSignature: Manage client signatures within the platform.

- Protection Plus: Provides EA and CPA help for notice resolution and ID theft restoration.

- Pay-by-Refund: Offers clients a convenient refund transfer payment option.

- Tax Scan and Import: Quickly import data from scanned documents.

- Client Portal: Use a secure portal for client communication and data exchange.

Training and Support

Intuit provides comprehensive training and support resources, including:

- Easy Start Onboarding: A detailed guide to help you get started.

- Personalized Support: U.S.-based phone support and personalized assistance.

- Training Resources: Live and recorded webinars with CPE and CE credit options.

- Self-Serve Options: Knowledge-based articles and on-screen help.

- Professional Community: Connect with other tax professionals and experts.

By choosing Intuit Accountants professional tax software, you gain access to powerful tools, comprehensive support, and a community of professionals to help you succeed.