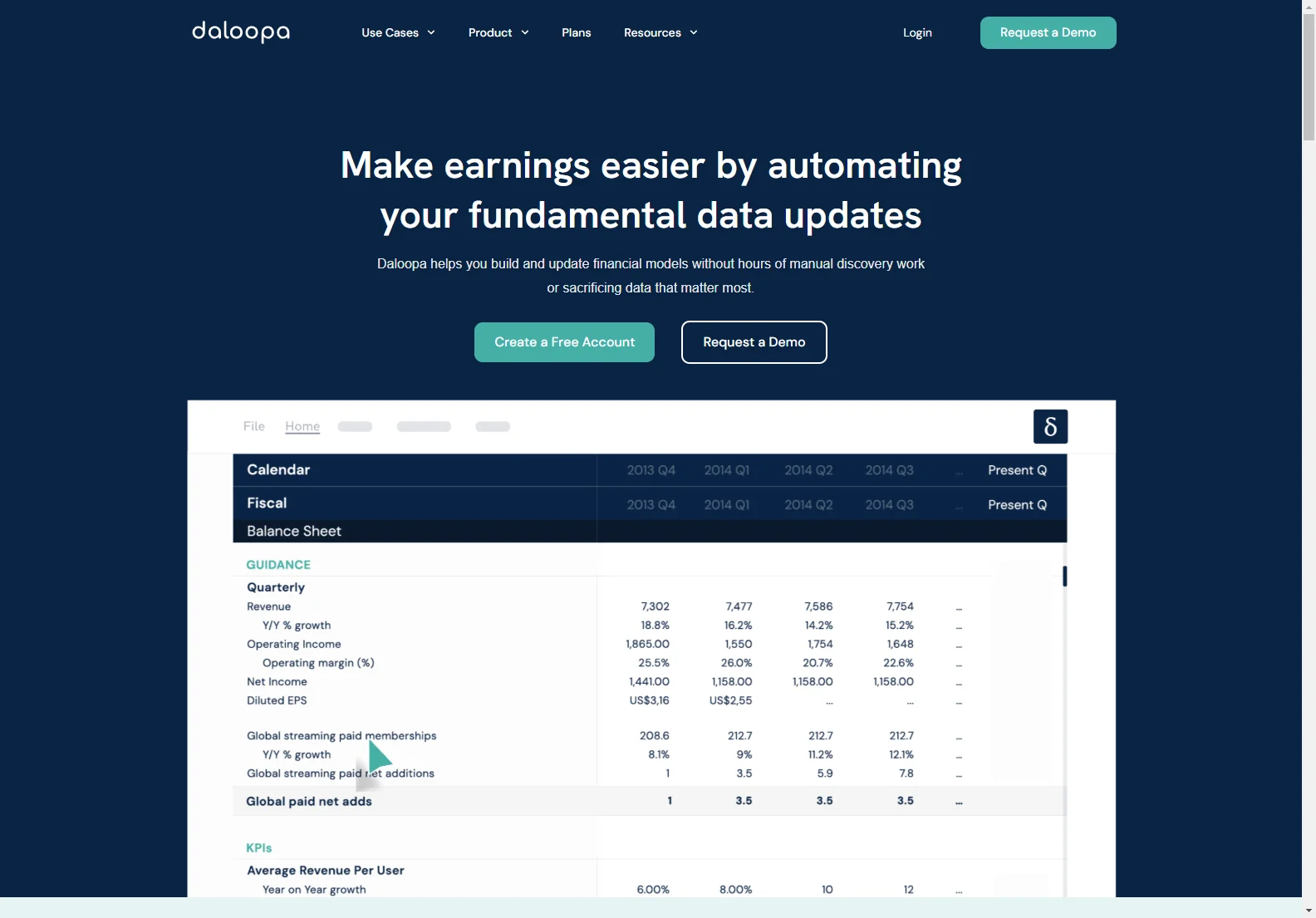

Daloopa: AI-Powered Financial Modeling for Faster, More Informed Decisions

Daloopa is an AI-powered financial modeling tool designed to help equity analysts and investment professionals significantly reduce the time spent on manual data updates and model building. By automating tedious tasks, Daloopa frees up analysts to focus on higher-value activities like generating insights and developing alpha-generating investment strategies.

Key Features and Benefits

- Automated Data Updates: Daloopa automatically updates financial models during earnings season, eliminating the manual work involved in incorporating new data. This ensures models are always current and accurate.

- Faster Model Building: Building new financial models from scratch is significantly accelerated with Daloopa's comprehensive dataset and intuitive interface. Analysts can quickly initiate coverage of new companies and get up to speed faster.

- Comprehensive Data: Daloopa provides access to a vast database covering 3,500+ companies, with 10+ years of historical data, including KPIs, adjustments, GAAP to Non-GAAP reconciliations, and guidance. The data is complete, accurate, and auditable.

- AI-Powered Data Scrubbing: Daloopa leverages AI to clean and organize financial data from various sources, ensuring the highest level of accuracy and consistency.

- Flexible Data Delivery: Data can be accessed via Excel data sheet downloads or a direct feed into existing models, catering to individual workflows.

- Industry Comparisons: Daloopa facilitates the creation of industry comparison models, providing a broader perspective on relative opportunities and market trends.

Use Cases

Daloopa is beneficial for a wide range of financial professionals, including:

- Equity Analysts: Streamline model building and updating, freeing up time for in-depth analysis and idea generation.

- Portfolio Managers: Ensure models are always up-to-date with accurate data, leading to better investment decisions.

- Investment Bankers: Improve efficiency in preparing presentations and conducting due diligence.

- Hedge Fund Managers: Gain a competitive edge by making faster, more informed investment decisions.

Pricing and Plans

Daloopa offers several flexible plans to meet the needs of different users:

- Free: Access to 5 free models to get started.

- Standard: Includes the Excel add-in for easy model linking and one-click updates.

- Plus: All the benefits of Standard, plus instant filing updates and incremental KPI updates.

Comparison with Other Tools

While several other financial modeling tools exist, Daloopa distinguishes itself through its AI-powered data accuracy, comprehensive dataset, and seamless integration with existing workflows. Unlike many competitors that require extensive manual data entry and reconciliation, Daloopa automates these processes, saving analysts valuable time and effort.

Conclusion

Daloopa is a powerful tool that can significantly enhance the efficiency and effectiveness of financial modeling. By automating data updates and providing access to a comprehensive, accurate dataset, Daloopa empowers analysts to focus on what matters most: generating insights and making better investment decisions.