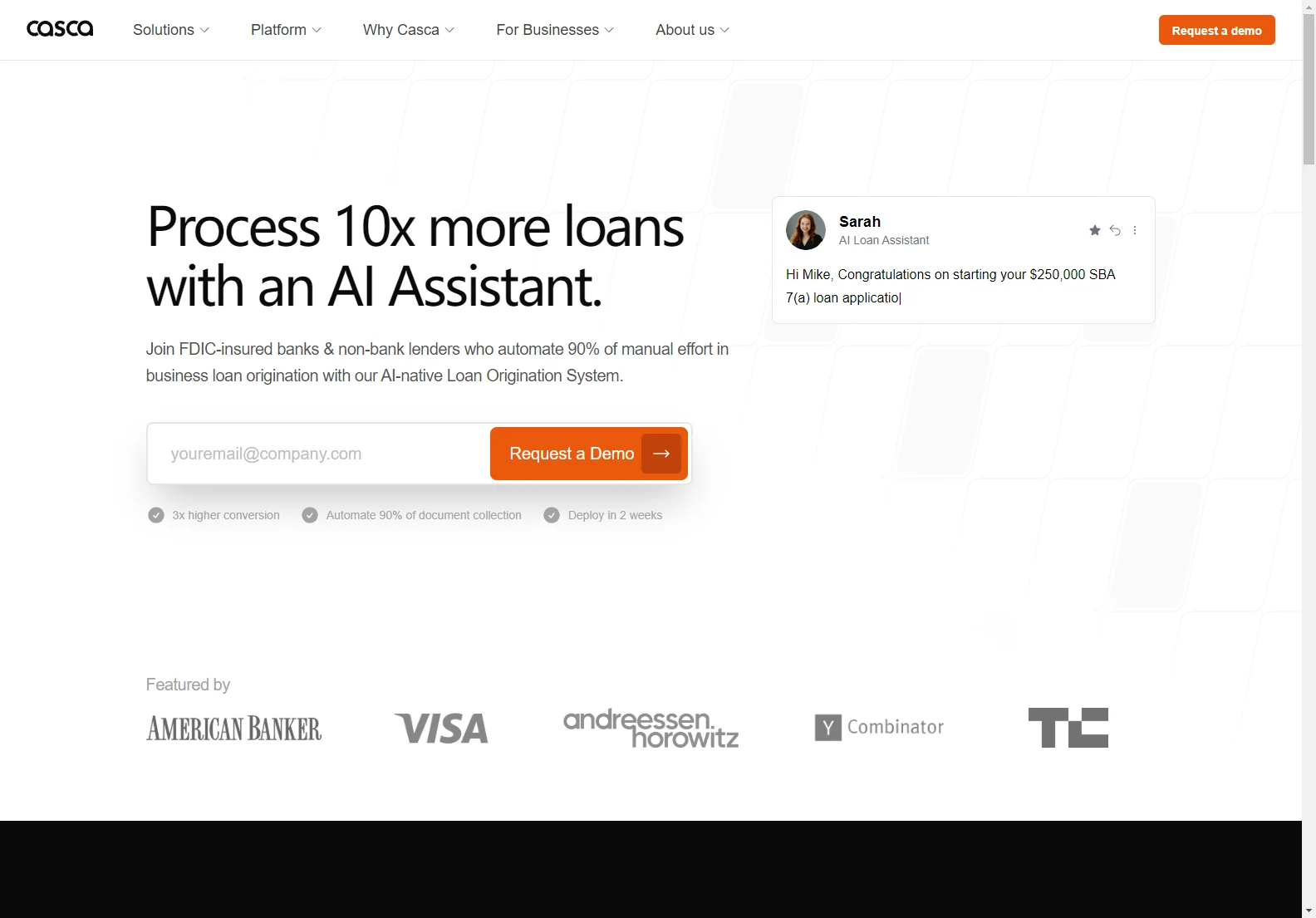

Casca: Revolutionizing Loan Origination with AI

Casca is an AI-powered loan origination system (LOS) designed to streamline and accelerate the business loan process for banks and lenders. By automating 90% of manual tasks, Casca helps institutions process 10x more loans and achieve 3x higher conversion rates. This article delves into the key features and benefits of Casca, highlighting its impact on efficiency and customer experience.

Key Features and Benefits

- AI-Powered Loan Assistant: Casca's intelligent assistant guides applicants through the process, providing 24/7 support and instant responses to queries. This significantly reduces response times and improves customer satisfaction.

- Automated Document Collection: The system automates the collection of necessary documents, eliminating manual effort and reducing processing time. It supports over 100 document types.

- Instant KYB and Credit Checks: Casca integrates with credit bureaus and performs instant Know Your Business (KYB) checks, accelerating the verification process.

- Real-time Application Tracking: A user-friendly portal allows borrowers to track their application progress in real-time, enhancing transparency and communication.

- Automated Decisioning: Casca's AI algorithms analyze financial data and generate instant decisions, speeding up the approval process.

- Automated Document Generation: The system automatically generates necessary loan documents, reducing manual workload and ensuring accuracy.

How Casca Improves Loan Origination

Before Casca, the loan origination process often involved:

- Clunky front-end forms and PDFs

- Manual responses with long wait times

- Manual follow-up, leading to delays

- Manual KYB and credit checks

- Manual document analysis and financial ratio calculations

- Manual document generation

Casca replaces these manual processes with automated workflows, resulting in:

- Increased Efficiency: Automate 90% of manual tasks, freeing up loan officers to focus on higher-value activities.

- Faster Processing Times: Reduce processing time from days to minutes, improving turnaround time for borrowers.

- Higher Conversion Rates: Improve the borrower experience and increase application completion rates.

- Reduced Costs: Lower operational costs by automating manual tasks.

- Improved Compliance: Ensure compliance with regulatory requirements through automated checks and processes.

Comparisons with Other AI Loan Origination Systems

While many AI-powered LOS solutions exist, Casca differentiates itself through its comprehensive automation, intuitive user interface, and robust AI capabilities. Unlike some competitors that focus on specific aspects of the loan process, Casca offers a complete end-to-end solution. This integrated approach ensures seamless workflow and maximum efficiency.

Conclusion

Casca is transforming the business loan origination process by leveraging the power of AI to automate tasks, improve efficiency, and enhance the borrower experience. Its comprehensive features and intuitive design make it a valuable tool for banks and lenders looking to modernize their operations and stay ahead of the competition.