Addy AI: Revolutionizing Mortgage Lending with AI

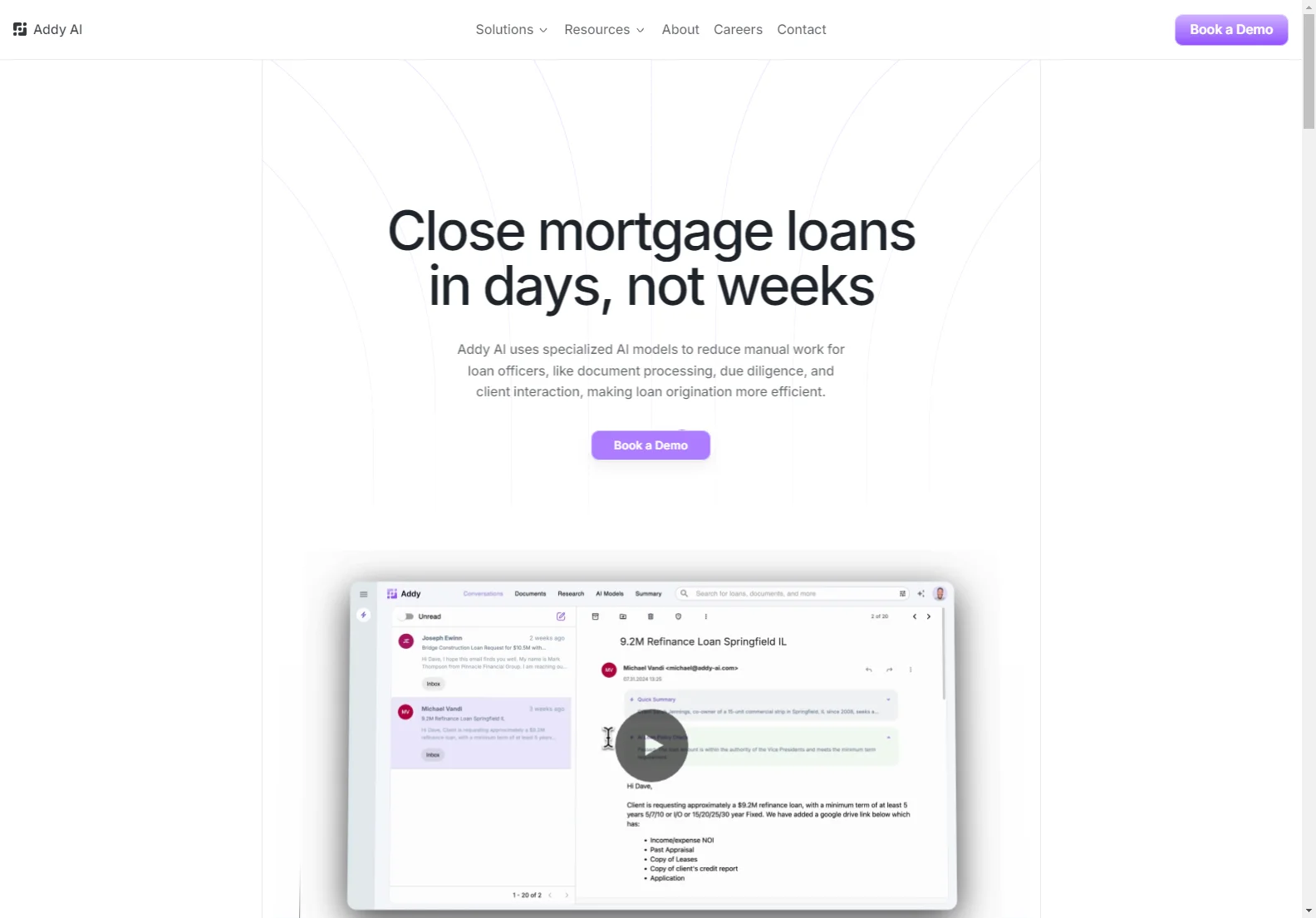

Addy AI is transforming the mortgage lending industry by leveraging the power of specialized AI models to streamline loan origination. This innovative platform automates time-consuming tasks, allowing loan officers to focus on what matters most: building relationships and closing deals. Addy AI achieves this by automating document processing, due diligence, and client interaction, resulting in significantly faster loan processing times.

Key Features of Addy AI

- Instant Loan Assessments: Addy AI instantly analyzes loan applications to ensure compliance with credit policies, providing immediate feedback and suggestions for improvement. This significantly reduces processing time and improves efficiency.

- Rapid Data Extraction: Extract crucial loan data, such as Loan-to-Value (LTV) ratios, from various sources (documents, emails, etc.) in seconds. This allows for faster review and decision-making.

- Seamless CRM Integration: Integrate Addy AI with your existing CRM to automatically sync and update loan data, creating a unified and efficient workflow.

- Automated Client Follow-up: Train specialized AI models to handle client communication around the clock, ensuring timely follow-ups and enhancing client satisfaction.

- AI-Powered Document Processing: Automate the processing of mortgage documents using state-of-the-art computer vision technology. This eliminates manual data entry and reduces errors.

- Natural Language Processing for Documents: Interact with mortgage documents using natural language queries to quickly find the specific information you need.

- Trainable AI Assistant: Customize your AI assistant to handle specific tasks and adhere to your loan policies, ensuring consistent and accurate processing.

- Secure and Private Platform: Addy AI is Google Security Certified, ensuring the security and privacy of your data.

Benefits of Using Addy AI

- Increased Efficiency: Automate manual tasks, freeing up loan officers to focus on higher-value activities.

- Faster Loan Origination: Reduce loan processing time from weeks to days, improving turnaround times and client satisfaction.

- Improved Accuracy: Minimize errors associated with manual data entry and processing.

- Enhanced Client Experience: Provide timely and consistent communication, leading to happier clients.

- Competitive Advantage: Stay ahead in the competitive lending market by leveraging cutting-edge AI technology.

Addy AI vs. Traditional Mortgage Lending

Traditional mortgage lending processes often involve significant manual work, leading to delays and inefficiencies. Addy AI offers a significant improvement by automating many of these tasks. For example, while traditional methods might take weeks to process a loan application, Addy AI can significantly reduce this time, potentially to days. This speed advantage allows lenders to close more loans and improve client satisfaction.

Conclusion

Addy AI is a powerful tool for mortgage lenders looking to improve efficiency, speed up loan origination, and enhance the client experience. By automating key tasks and providing valuable insights, Addy AI empowers lenders to stay competitive in today's fast-paced market. Its focus on security and privacy ensures that sensitive data is handled responsibly.