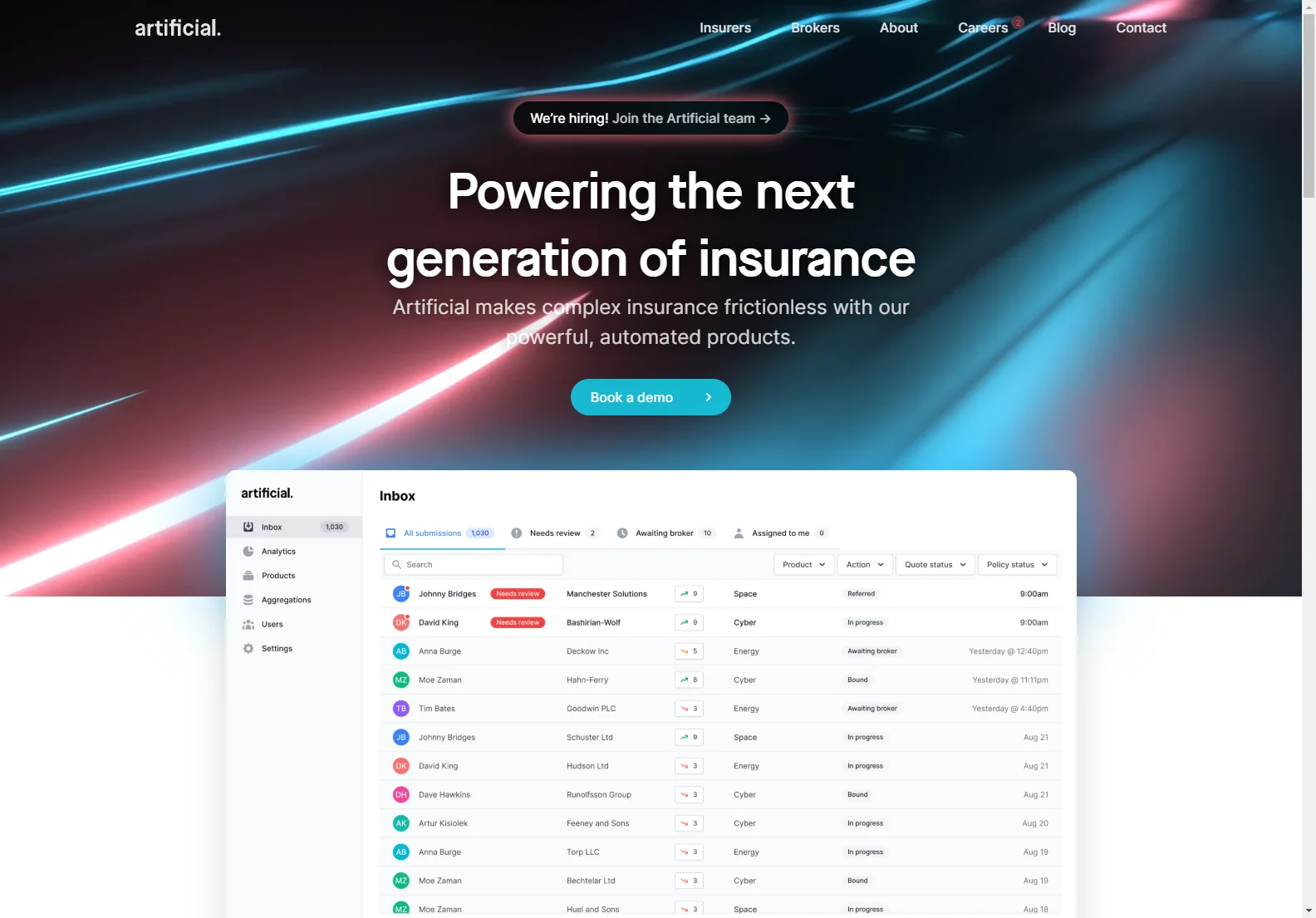

Artificial: Powering the Next Generation of Insurance

Artificial is revolutionizing the insurance industry with its powerful, automated products designed to make complex processes frictionless. This platform offers significant benefits for both insurers and brokers, streamlining operations and driving maximum growth and efficiency.

Key Features and Benefits

- Underwriting Platform: Harness your data to write better risks and significantly reduce underwriting time. The platform allows for more accurate risk selection, leading to improved performance and reduced loss ratios.

- Contract Builder: Eliminate complex data entry and create flexible, digital, and compliant contracts quickly and easily. This feature drastically cuts the cost of processing complex submissions.

- Increased Efficiency: Experience up to 8x faster underwriting, freeing up valuable time for high-value tasks and improving overall business performance.

- Cost Reduction: Reduce the cost of processing complex submissions by up to 90%, leading to significant cost savings.

Case Study: Partnering with BMS Group

The successful implementation of Artificial's Contract Builder at BMS Group demonstrates the platform's transformative capabilities. This collaborative project not only streamlines contract documentation but also positions BMS for success in the evolving digital landscape of the London insurance market. The project highlights the ease of integration and the significant efficiency gains achievable with Artificial's tools.

Comparisons with Existing Solutions

While many solutions offer aspects of automation in insurance, Artificial distinguishes itself through its comprehensive, integrated platform. Unlike solutions focusing solely on a single aspect of the insurance process, Artificial provides a holistic approach, addressing underwriting, contract creation, and overall efficiency. This integrated approach provides a synergistic effect, maximizing the benefits for users.

Conclusion

Artificial is more than just an AI-powered tool; it's a strategic partner for insurance companies seeking to modernize their operations and gain a competitive edge. By streamlining processes, reducing costs, and improving accuracy, Artificial empowers businesses to write more business, faster, and more efficiently.