Wealthfront: A Comprehensive Guide to Automated Investing and Wealth Management

Wealthfront is a robo-advisor platform designed to simplify investing and help users grow their wealth. It offers a range of services, from high-yield cash accounts to automated investing portfolios and individual stock trading. This guide provides a detailed overview of Wealthfront's features, benefits, and potential drawbacks.

Key Features and Services

Wealthfront's core offerings include:

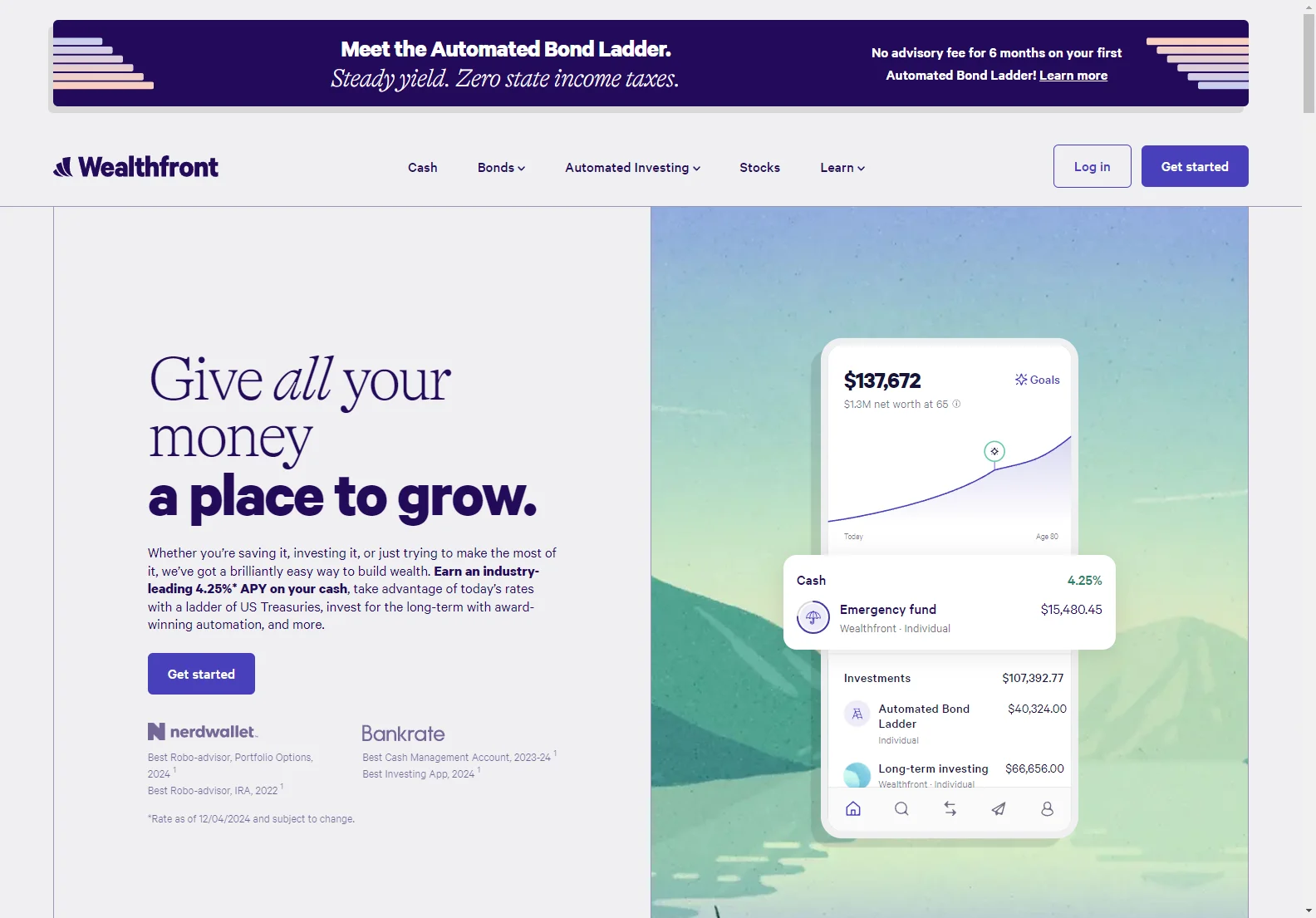

- High-Yield Cash Account: Earn a competitive annual percentage yield (APY) on your cash, with easy access and no minimum balance requirements.

- Automated Bond Ladder: Invest in a diversified portfolio of US Treasuries for steady yield and tax advantages.

- Automated Investing Account: Utilize algorithms to create and manage a diversified investment portfolio tailored to your risk tolerance and financial goals.

- Stock Investing Account: Trade individual stocks with zero commissions.

Benefits of Using Wealthfront

- Automation: Wealthfront's automated investment strategies simplify the investment process, handling rebalancing and tax-loss harvesting.

- Diversification: Portfolios are designed to be diversified across various asset classes, reducing risk.

- Low Fees: Wealthfront's fees are generally lower than those of traditional financial advisors.

- Accessibility: The platform is user-friendly and accessible through a mobile app and website.

- Tax Efficiency: Wealthfront employs tax-loss harvesting to minimize your tax liability.

Potential Drawbacks

- Limited Human Interaction: Wealthfront is primarily a robo-advisor, offering limited personal interaction with financial advisors.

- Algorithm Dependence: Investment performance is dependent on the effectiveness of Wealthfront's algorithms.

- Investment Choices: While offering diversification, the range of investment options may be more limited than with a traditional brokerage account.

Comparisons with Other Robo-Advisors

Wealthfront competes with other robo-advisors such as Betterment and Schwab Intelligent Portfolios. While all offer automated investing, they differ in fees, investment options, and features. A detailed comparison should be conducted to determine which platform best suits individual needs.

Conclusion

Wealthfront provides a user-friendly and automated approach to investing, making it accessible to a wide range of users. Its strengths lie in its automation, diversification strategies, and low fees. However, users should carefully consider the limitations of a robo-advisor approach before making a decision.