wallet.AI: AI-Powered Financial Decisions

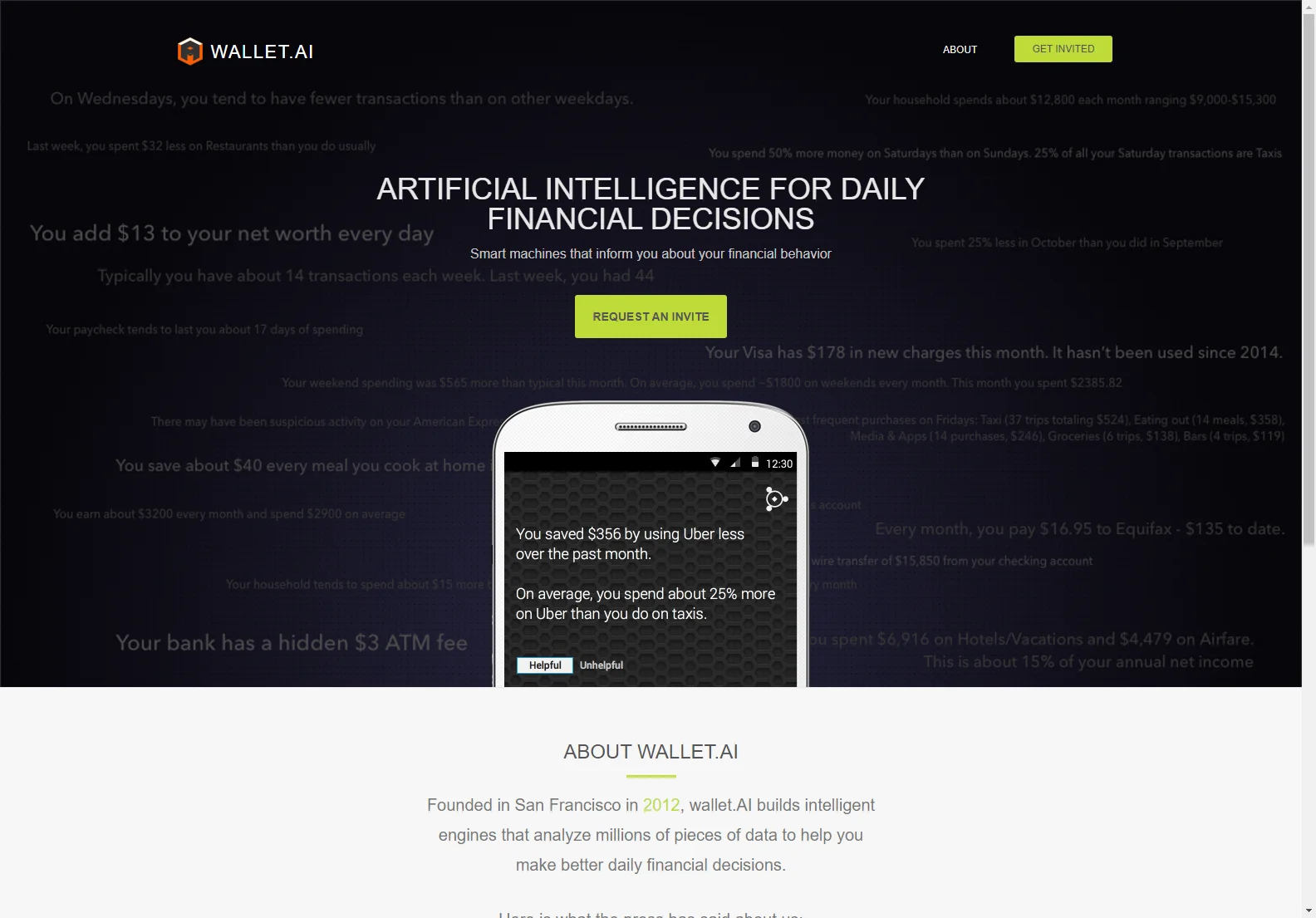

wallet.AI, founded in San Francisco in 2012, is an AI-powered platform designed to help users make better daily financial decisions. It leverages sophisticated algorithms to analyze vast amounts of financial data, providing users with personalized insights and recommendations.

Key Features

- Personalized Financial Analysis: wallet.AI analyzes individual spending habits, income patterns, and investment portfolios to offer tailored financial advice.

- Predictive Modeling: The platform utilizes predictive modeling to forecast future financial trends and potential risks.

- Automated Recommendations: Users receive automated recommendations for budgeting, saving, investing, and debt management.

- Data Visualization: Complex financial data is presented in clear, easy-to-understand visualizations.

- Secure Data Handling: wallet.AI employs robust security measures to protect user data.

Use Cases

- Budgeting and Saving: Create and track budgets, identify areas for savings, and set financial goals.

- Investment Management: Receive personalized investment recommendations and monitor portfolio performance.

- Debt Management: Develop strategies for paying down debt more efficiently.

- Financial Planning: Plan for major life events such as retirement or home purchases.

Comparisons

While several other AI-powered financial tools exist, wallet.AI distinguishes itself through its advanced predictive modeling capabilities and personalized recommendations. Unlike simpler budgeting apps, wallet.AI offers a more comprehensive approach to financial management, incorporating investment strategies and debt reduction planning.

Conclusion

wallet.AI provides a powerful and user-friendly platform for individuals seeking to improve their financial well-being. Its advanced AI capabilities and personalized approach make it a valuable tool for anyone looking to take control of their finances.