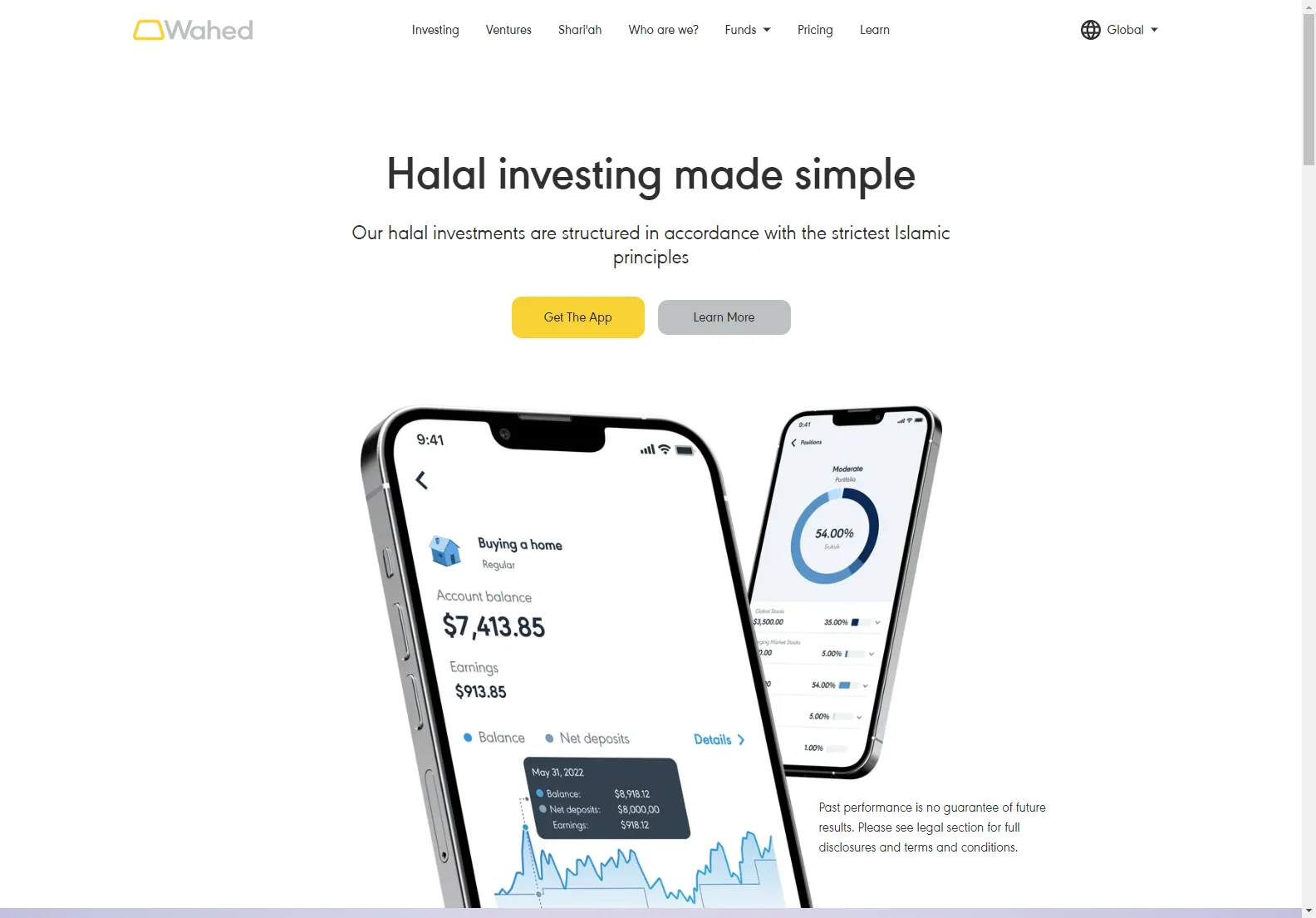

Wahed: Halal Investing Made Simple

Wahed Invest is a financial technology company offering Shariah-compliant investment products. They cater to a growing market of investors seeking ethical and faith-based investment options. Their platform simplifies the process of investing in accordance with Islamic principles, making it accessible to a wider audience.

Key Features:

- Shariah-compliant investments: All investments offered by Wahed adhere to Islamic finance principles, avoiding interest (riba) and investments in prohibited industries.

- Accessibility: The platform is designed for ease of use, making it accessible to both novice and experienced investors.

- Transparency: Wahed provides clear and concise information about its investment strategies and fees.

- Community: Wahed fosters a community of like-minded investors who share similar values.

- Variety of investment options: Wahed offers a range of investment options to suit different risk tolerances and financial goals.

How it Works:

The process of investing with Wahed is straightforward. Users open an account, select their investment preferences based on risk tolerance, and fund their account. Wahed handles the investment management, eliminating the need for complex paperwork or meetings.

Target Audience:

Wahed primarily targets Muslim investors seeking Shariah-compliant investment options. However, their platform's simplicity and transparency also appeal to individuals interested in ethical and responsible investing.

Comparisons with Other Platforms:

Compared to traditional investment platforms, Wahed distinguishes itself by its strict adherence to Shariah principles. Unlike many robo-advisors that may offer some ethically-screened funds, Wahed's entire investment process is built around Islamic finance guidelines. This focus sets it apart and caters to a specific niche market.

Conclusion:

Wahed Invest provides a valuable service to those seeking Shariah-compliant investment options. Its user-friendly platform, transparent practices, and commitment to ethical investing make it a compelling choice for a growing segment of the investment market.