Planck: Revolutionizing Commercial Insurance with Generative AI

Planck is a game-changing AI platform designed to empower commercial insurance underwriters. By leveraging the power of generative AI (GenAI), Planck provides unparalleled accuracy, consistency, and accountability in assessing risk. This innovative platform helps underwriters confidently navigate complex datasets, classify businesses effectively, and identify crucial risk factors, ultimately leading to more informed and efficient underwriting processes.

Key Features and Capabilities

- Enhanced Data Analysis: Planck's GenAI models are enriched with unique contextual information, allowing for a deeper understanding of patterns, trends, and key risks within the commercial insurance domain. The platform combines multiple neural networks to provide comprehensive insights.

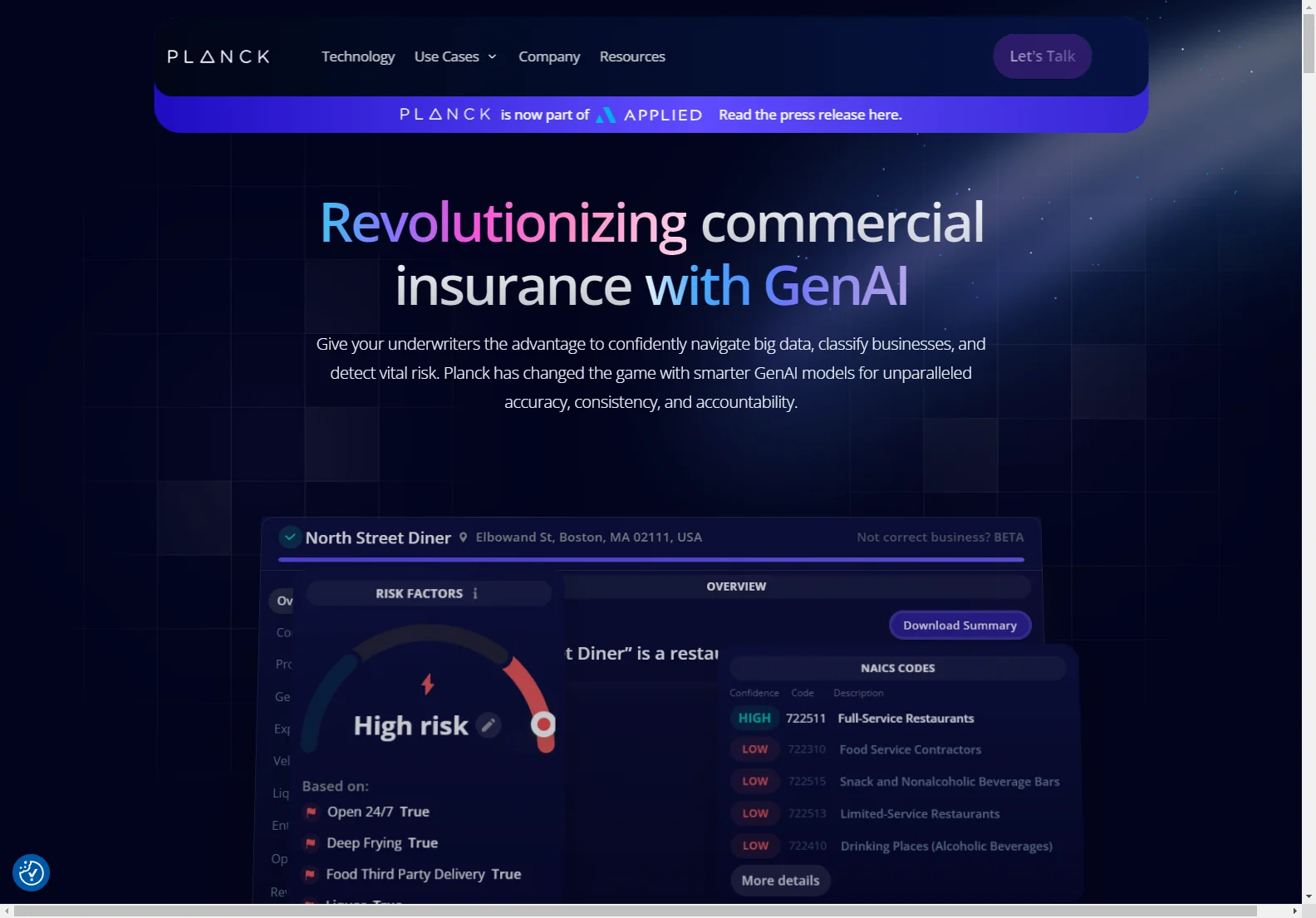

- Accurate Risk Assessment: Specifically trained for commercial insurance underwriting, Planck offers superior accuracy in risk prediction and classification. The system provides evidence-backed transparency and confidence scoring, allowing underwriters to understand the logic behind the assessments.

- Actionable Insights: Planck generates actionable insights, answers, and recommendations to support strategic decision-making. It helps underwriters uncover hidden correlations and potential risks that might be missed through traditional manual analysis.

- Customizable Insights: The platform allows for customization of insights to align with specific risk definitions and organizational requirements.

- User-Friendly Interface: Planck's intuitive interface makes it easy for underwriters to access and interpret the AI-driven insights. The platform provides a seamless integration into existing workflows.

- Comprehensive Risk Assessment: Planck offers a complete and business-specific risk assessment, covering various aspects from submission to bind to renewal.

- Predictive Capabilities: The platform helps underwriters stay ahead of emerging market trends and evolving risks through predictive insights.

Use Cases

Planck's GenAI capabilities are particularly beneficial for:

- Classifying Businesses: Accurately categorizing businesses based on their operations and risk profiles.

- Detecting Vital Risks: Identifying potential risks that might be overlooked through manual analysis.

- Improving Underwriting Efficiency: Streamlining the underwriting process and reducing processing time.

- Enhancing Decision-Making: Providing underwriters with data-driven insights to support informed decisions.

Planck PLUS: A Comprehensive Solution

Planck offers a tiered approach to AI integration, catering to different organizational needs and levels of AI maturity. Planck PLUS includes:

- PLUS Data: Provides enhanced underwriting data and classifications.

- PLUS Risk Workbench: Improves underwriting process and efficiency.

- Planck Enterprise: Offers enterprise-level solutions for large organizations.

Comparison with Other AI Solutions

While several AI solutions exist in the commercial insurance market, Planck distinguishes itself through its specialized training for commercial insurance underwriting, its focus on actionable insights, and its customizable approach to risk assessment. Unlike some general-purpose AI platforms, Planck is tailored to the specific needs and challenges of the insurance industry, providing a more accurate and relevant analysis.

Conclusion

Planck is transforming the commercial insurance landscape by providing underwriters with the tools they need to navigate the complexities of risk assessment with confidence and efficiency. Its advanced GenAI capabilities, coupled with a user-friendly interface and customizable features, make it a powerful asset for any commercial insurance organization looking to leverage the power of AI.