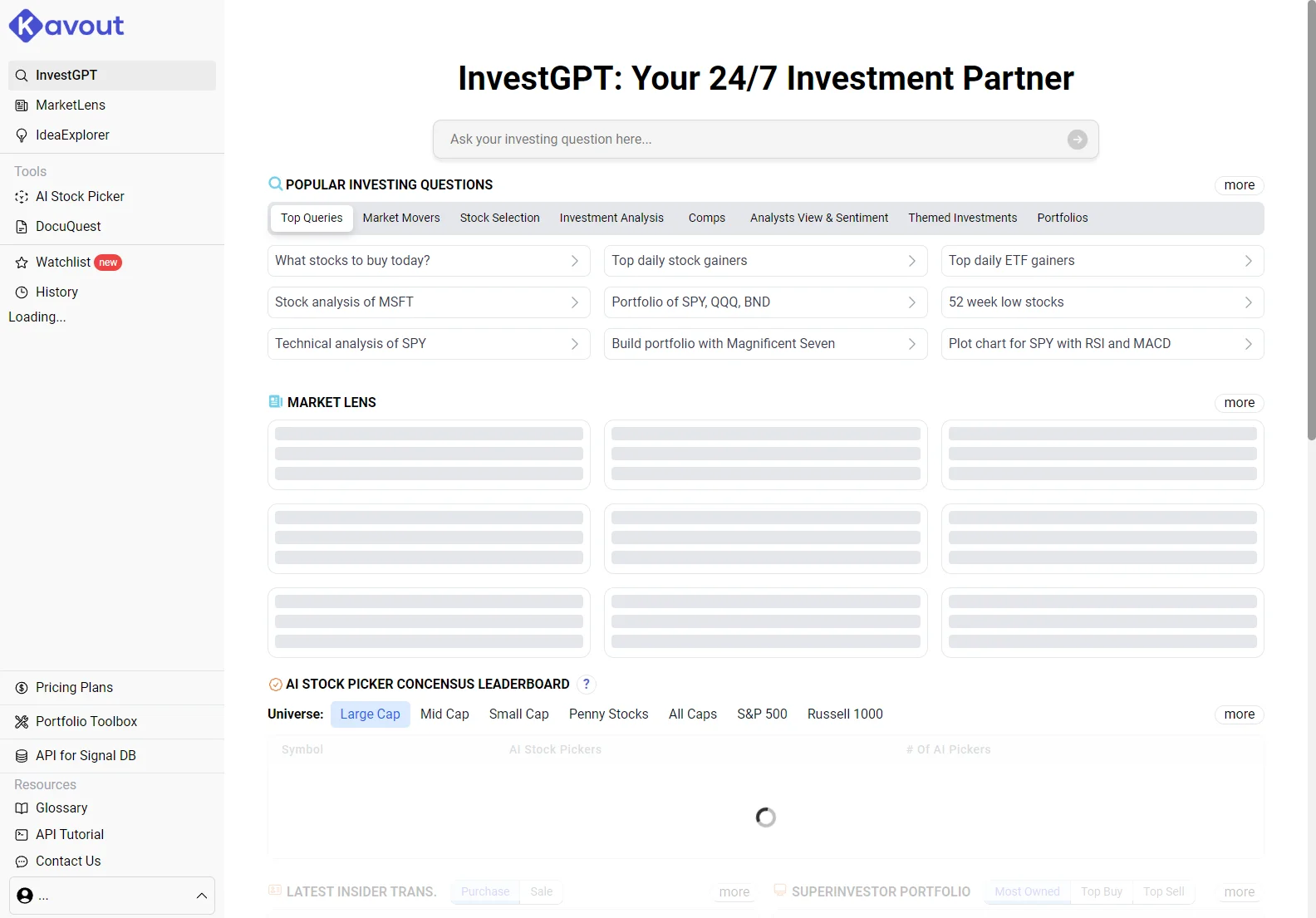

Enhance Your Investment Decisions with Kavout and InvestGPT: Expert AI Insights on U.S. Stocks and ETFs

Kavout and its AI-powered tool, InvestGPT, offer a unique approach to investment analysis, providing users with valuable insights into the U.S. stock and ETF markets. This platform goes beyond simple stock screeners, offering a comprehensive suite of tools designed to help investors of all levels make more informed decisions.

Key Features of InvestGPT and Kavout

- AI-Driven Stock Picking: InvestGPT utilizes advanced algorithms to analyze vast amounts of market data, identifying potential investment opportunities based on various factors such as financial performance, market trends, and news sentiment. The AI stock picker provides a consensus leaderboard, showing which stocks are most frequently picked by the AI models.

- Comprehensive Market Lens: The Market Lens feature provides a holistic view of the market, allowing users to quickly identify market movers, top gainers and losers, and stocks hitting 52-week highs or lows. This bird's-eye view helps investors stay informed about market dynamics.

- In-Depth Stock Analysis: InvestGPT goes beyond simple price data, offering detailed analysis of individual stocks, including technical indicators (RSI, MACD), analyst views and sentiment, and comparisons to similar companies. This allows for a more nuanced understanding of each investment opportunity.

- Portfolio Management Tools: The platform provides tools to help users build, manage, and track their portfolios. Users can create custom watchlists, monitor portfolio performance, and receive alerts on significant price changes or news events.

- Access to Expert Insights: While not explicitly stated as a feature, the implication is that the AI's analysis is based on a sophisticated understanding of market dynamics, providing insights that would typically require extensive research and expertise.

How InvestGPT Differs from Other AI Stock Pickers

Many AI stock pickers focus solely on predicting price movements. InvestGPT distinguishes itself by offering a more comprehensive suite of tools, including market analysis, portfolio management, and access to various data points. This holistic approach allows investors to make better-informed decisions, rather than relying solely on price predictions.

While a direct comparison to specific competitors is not possible without naming them (against the provided guidelines), it's clear that InvestGPT aims to provide a more complete investment ecosystem than many other AI-driven platforms.

User Experience and Interface

The platform's user interface is intuitive and easy to navigate, allowing users to quickly access the information they need. The design is clean and uncluttered, making it easy to focus on the key data points.

Conclusion

InvestGPT, powered by Kavout, offers a powerful and comprehensive suite of tools for investors looking to leverage AI to enhance their investment decisions. Its combination of AI-driven stock picking, in-depth market analysis, and portfolio management tools makes it a valuable resource for both novice and experienced investors. However, remember that no investment strategy is foolproof, and users should always conduct their own thorough research before making any investment decisions.