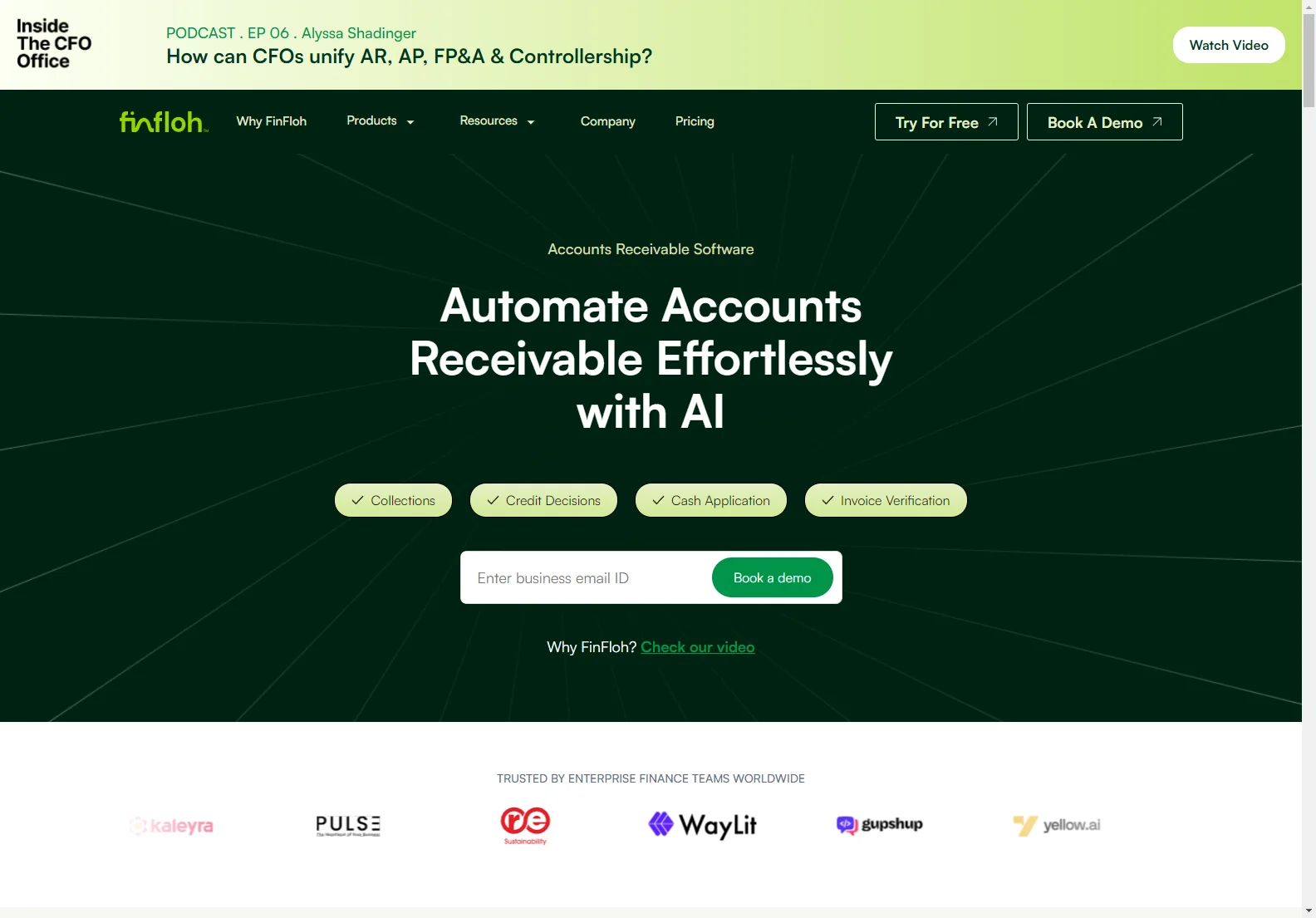

FinFloh: Accounts Receivable Automation Software

FinFloh is an AI-powered accounts receivable (AR) automation software designed to streamline the invoice-to-cash process for B2B finance teams. It helps businesses collect receivables faster, reduce Days Sales Outstanding (DSO), and minimize bad debt. This comprehensive platform integrates seamlessly with existing ERP and CRM systems, automating key tasks and providing valuable insights to improve financial performance.

Key Features of FinFloh

- AI-Powered Collections: FinFloh uses AI to prioritize collections efforts, automating follow-ups and optimizing communication strategies for maximum efficiency. This includes predictive analytics to anticipate potential payment delays.

- Automated Cash Application: The platform automatically extracts payment information, matches it with invoices, and posts cash to your ERP system, significantly reducing manual effort and errors.

- ML-Driven Credit Scoring: FinFloh's machine learning algorithms analyze buyer behavior and market intelligence to provide accurate credit scoring and risk assessment, enabling faster and more informed credit decisions.

- Dispute Resolution: A centralized communication platform facilitates seamless interaction between buyers and sellers, enabling faster resolution of invoice disputes with customizable workflows and predictive analytics.

- Seamless Integrations: FinFloh integrates with major ERP and CRM systems, ensuring data consistency and minimizing manual data entry.

Benefits of Using FinFloh

- Reduced DSO: Automate processes to shorten the time it takes to collect payments.

- Improved Cash Flow: Faster collections lead to improved cash flow predictability and management.

- Increased Efficiency: Automate manual tasks, freeing up your team to focus on strategic initiatives.

- Reduced Errors: Automation minimizes human error in cash application and invoice processing.

- Better Decision-Making: AI-powered insights provide a clearer picture of your AR performance.

FinFloh vs. Other AR Solutions

Compared to other AR solutions, FinFloh stands out due to its comprehensive AI capabilities. While many solutions offer basic automation, FinFloh's predictive analytics and machine learning features provide a more proactive and intelligent approach to AR management. This allows for more accurate forecasting, proactive risk mitigation, and ultimately, a more efficient and profitable AR process. Other solutions may lack the depth of integration or the advanced AI features that FinFloh provides.

Conclusion

FinFloh offers a powerful and comprehensive solution for businesses looking to optimize their accounts receivable processes. By leveraging AI and automation, FinFloh helps finance teams improve efficiency, reduce costs, and accelerate cash flow. Its seamless integrations and user-friendly interface make it a valuable asset for any B2B company.