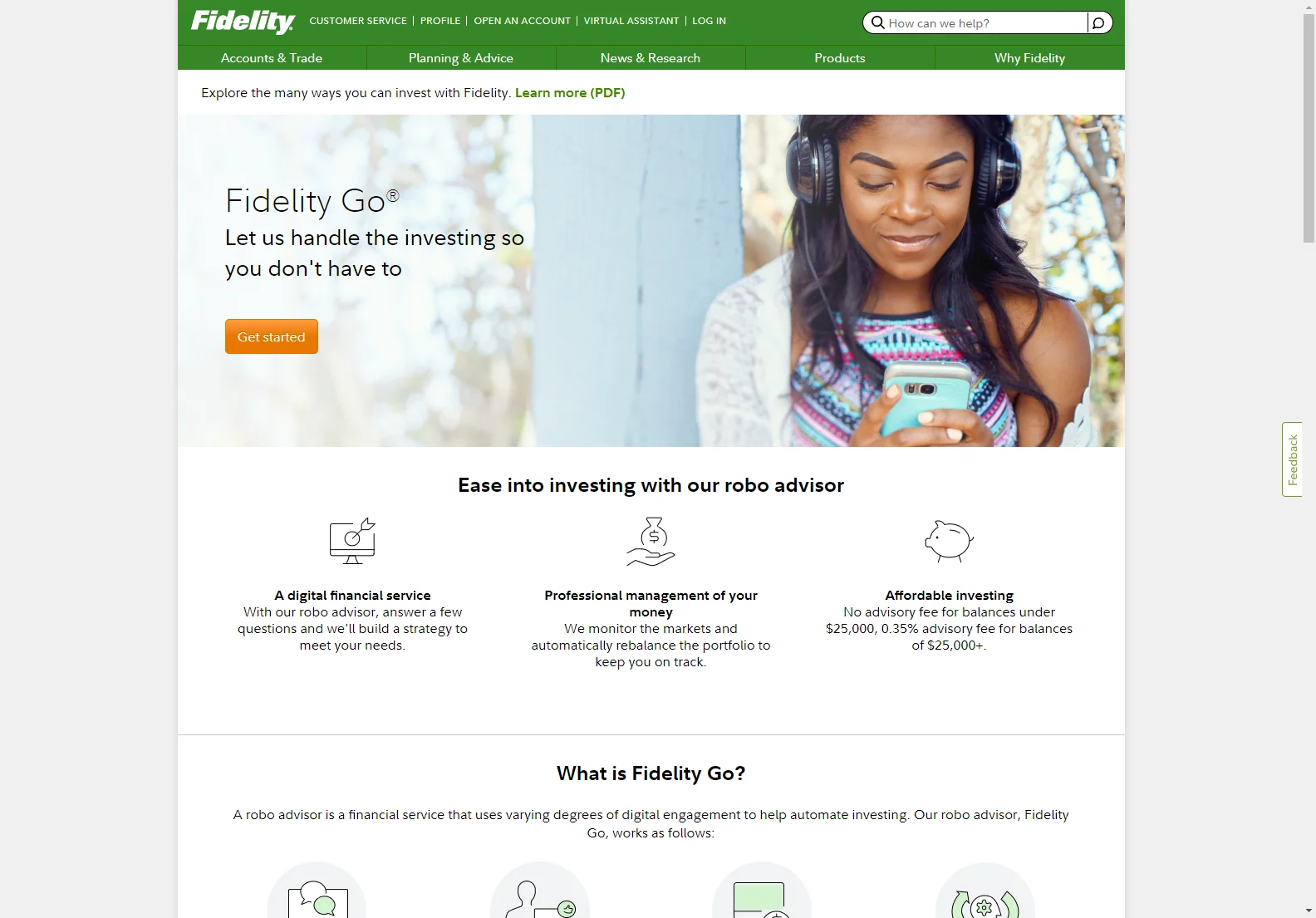

Fidelity Go: Your Affordable Robo-Advisor for Effortless Investing

Fidelity Go is a robo-advisor designed to simplify investing, making it accessible and affordable for everyone. Whether you're a seasoned investor or just starting, Fidelity Go offers a streamlined approach to managing your finances. This article will explore the key features, benefits, and costs associated with Fidelity Go, comparing it to other robo-advisors in the market.

Key Features of Fidelity Go

- Automated Investing: Fidelity Go uses algorithms to create and manage a personalized investment portfolio based on your financial goals, risk tolerance, and time horizon. This automation takes the guesswork out of investing, allowing you to focus on other aspects of your life.

- Affordable Pricing: There are no advisory fees for balances under $25,000, and a 0.35% annual fee for balances above that amount. This transparent pricing structure makes Fidelity Go competitive with other robo-advisors.

- Personalized Financial Coaching: For accounts with balances of $25,000 or more, Fidelity Go provides unlimited 30-minute coaching calls with trained advisors. These calls can cover budgeting, debt management, retirement planning, and other financial topics.

- Annual Reviews: Fidelity Go conducts annual reviews to assess your progress and adjust your investment strategy as needed, ensuring your portfolio remains aligned with your evolving financial goals.

- Easy Account Conversion: You can potentially convert existing eligible Fidelity brokerage or retirement accounts to Fidelity Go, simplifying your financial management.

- Investment Strategy Selection: Fidelity Go offers a range of investment strategies, from conservative to aggressive, allowing you to choose the level of risk that aligns with your comfort level.

- Investment Transparency: Your portfolio will consist of Fidelity Flex® mutual funds, which have zero expense ratios. The funds generally hold a combination of domestic and foreign stocks, bonds, and short-term investments.

Fidelity Go vs. Other Robo-Advisors

Fidelity Go stands out from other robo-advisors due to its combination of affordability, personalized coaching (for higher balances), and integration with the broader Fidelity ecosystem. While some competitors offer similar automated investing features, Fidelity Go's access to human advisors and its low fees make it a compelling option for many investors.

Getting Started with Fidelity Go

Opening a Fidelity Go account is straightforward. There's no minimum initial investment to open an account, although a $10 balance is required to begin investing. The process involves answering a few questions about your financial goals and risk tolerance, after which Fidelity Go will suggest a suitable investment strategy. You can then fund your account and let Fidelity Go handle the rest.

Conclusion

Fidelity Go provides a user-friendly and affordable way to automate your investments. Its combination of technology and human expertise makes it a strong contender in the robo-advisor market. The availability of personalized coaching for larger accounts adds significant value, making it a suitable choice for investors of all experience levels.