Betterment: Automated Investing and High-Yield Savings

Betterment is a robo-advisor platform offering automated investing, high-yield savings accounts, and retirement planning tools. This article explores its features, benefits, and how it compares to other similar services.

Key Features

- Automated Investing: Betterment creates and manages diversified investment portfolios based on your risk tolerance and financial goals. This includes automated rebalancing and dividend reinvestment.

- High-Yield Cash Account: Earn a competitive interest rate on your savings with Betterment's Cash Reserve account, significantly higher than traditional savings accounts.

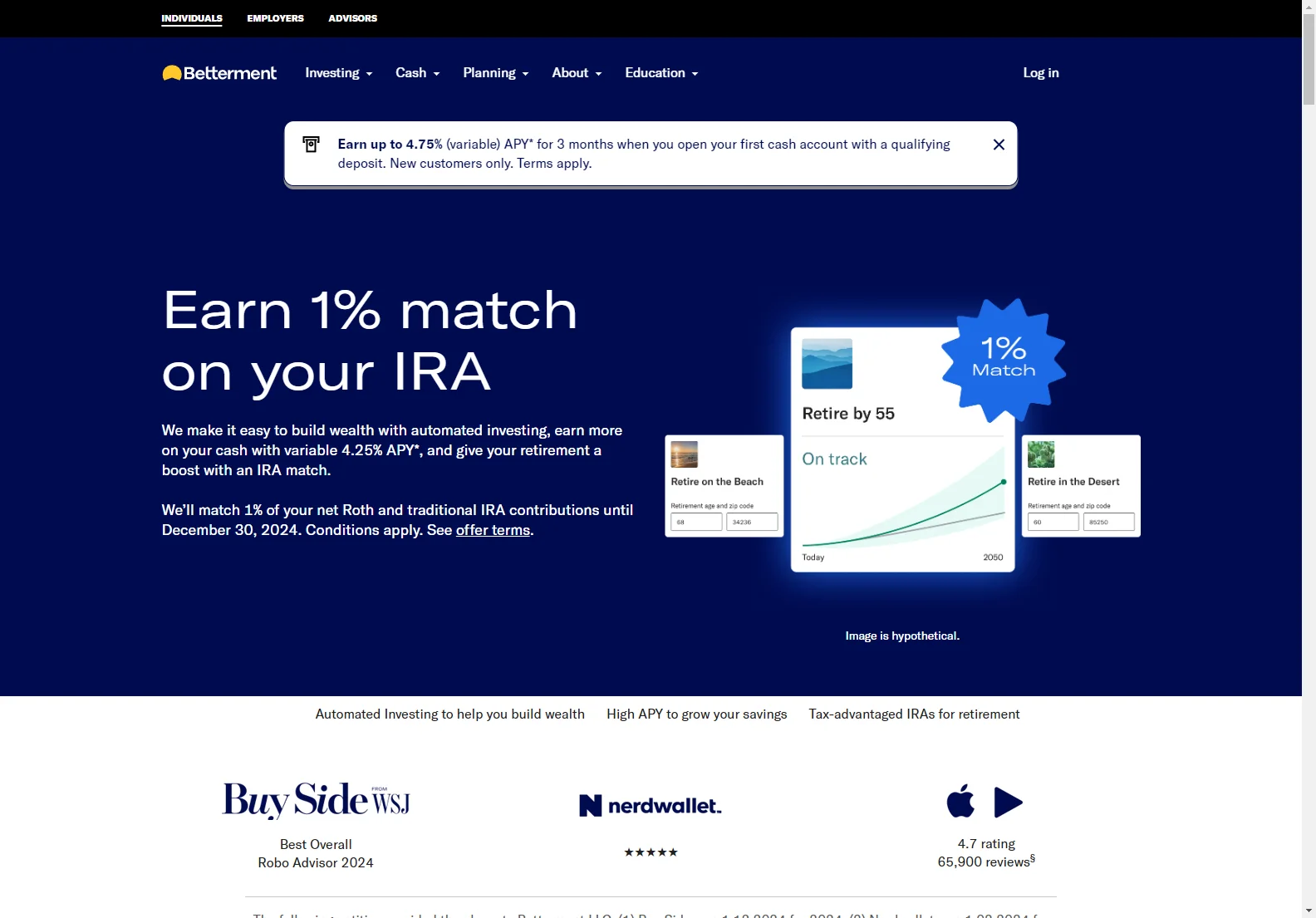

- Retirement Planning: Betterment offers Traditional, Roth, and SEP IRAs, along with planning tools and resources to help you save for retirement. They also provide IRA contribution matching.

- Tax-Loss Harvesting: Betterment utilizes tax-loss harvesting to potentially minimize your tax burden and offset advisory fees.

- Financial Planning Tools: Access to various tools and resources to help you track your progress towards your financial goals.

Benefits

- Simplicity and Ease of Use: The platform is designed to be user-friendly, making investing and managing your finances straightforward.

- Diversification: Automated portfolio management ensures your investments are diversified across different asset classes.

- Low Fees: Betterment's fees are generally competitive with other robo-advisors.

- High-Yield Savings: The Cash Reserve account provides a significant return on your cash savings.

- Tax Efficiency: Tax-loss harvesting helps reduce your overall tax liability.

Comparisons

Betterment competes with other robo-advisors such as Wealthfront and Schwab Intelligent Portfolios. While all offer automated investing, Betterment distinguishes itself with its high-yield cash account and robust retirement planning features. A direct comparison of fees and investment options is recommended before choosing a platform.

Pricing

Betterment's pricing structure varies depending on the services used. They offer different tiers of service with varying fees. It's crucial to review their fee schedule to understand the costs associated with their services.

Conclusion

Betterment provides a comprehensive platform for managing your investments and savings. Its automated investing, high-yield cash account, and retirement planning tools make it an attractive option for investors of all levels. However, potential users should carefully compare its features, fees, and investment options with other robo-advisors to determine the best fit for their individual needs.